As accounting professionals navigate the transition between asc 840 and asc 842 leases and consider the changes implemented in the tax cut and jobs act tcja of 2017 and the coronavirus aid relief and economic security act cares act enacted in march 2020 questions regarding the definitions of lease related terms and proper accounting application are in no short supply.

Roof leasehold improvements qualified.

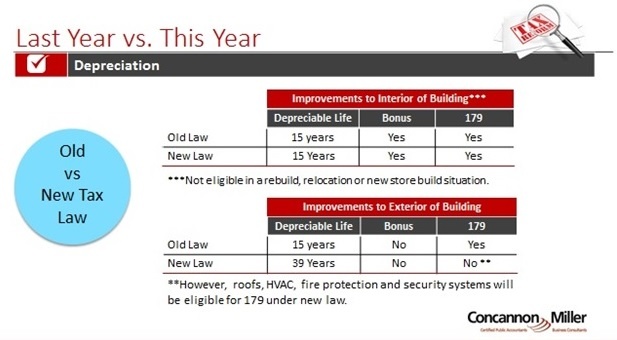

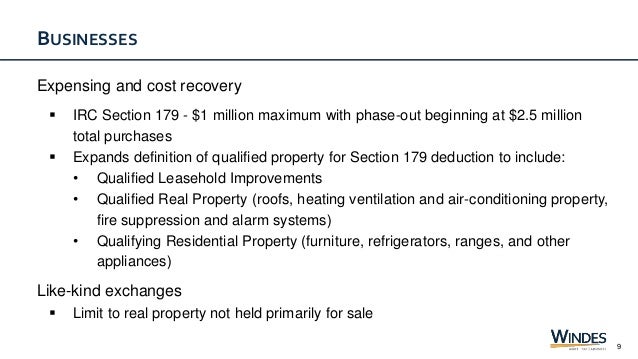

Qualified leasehold improvements and qualified improvement property are deductible over 15 years instead with an option for bonus depreciation the first year.

For taxable years beginning after 2018 these amounts of 1 million and 2 5 million will be adjusted for inflation.

For example hvac costs in a retail shopping center might include ductwork inside the building that is eligible for qip and package units on the roof that are not.

Examples of such qualifying improvements include installation or replacement of drywall ceilings interior doors fire protection mechanical electrical and plumbing.

The new law increased the maximum deduction from 500 000 to 1 million.

Tenant improvements often include items that are not eligible for qip treatment.

Prior to the tcja many interior improvements to nonresidential building were eligible for bonus depreciation as qip.

What is qualified leasehold improvement property.

The tcja eliminated the separate asset categories for qualified leasehold improvements qualified restaurant property and qualified retail improvement property effectively lumping all of these separate classes into one qip category.

It also increased the phase out threshold from 2 million to 2 5 million.

The tax cuts and jobs act of 2017 tcja allowed for 100 additional first year depreciation deductions 100 bonus depreciation for certain qualified property.

Qualified leasehold improvements must meet four conditions to be classified as an eligible depreciable asset.

The tcja eliminated pre existing definitions for 1 qualified leasehold improvement property 2 qualified restaurant property and 3 qualified retail improvement property.

Other examples include certain storefronts and interior seismic retrofits.

Qip is a new definition that encompasses leasehold improvements retail improvements and restaurant property.

The part of the building containing the improvement must be solely occupied by the lessee.

Leasehold improvements are typically made by the owner.

Interior spaces are modified according to the operating needs of the tenant for example changes made to ceilings flooring and inner walls.

Until a technical correction is made qip is assigned a 39 year life and therefore is not eligible for bonus depreciation.

Currently section 179 expensing is a great option for potentially writing off some or all of your qip expenses.